Apple’s Earnings Come With a Low Bar and Big Buyback Hopes

(Bloomberg) -- Apple Inc. is facing something unusual as it gears up to report its second-quarter results after the close: low expectations.

Most Read from Bloomberg

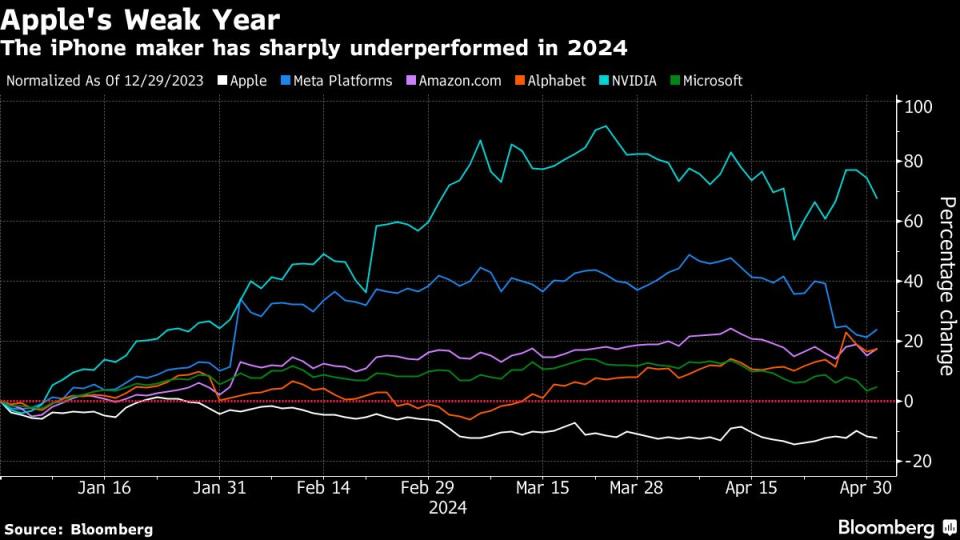

Its reputation as a haven that can outperform in all market conditions has been refuted this year, as it sharply lags peers with better growth, a clearer AI narrative, a cheaper price tag — or all of the above. The upshot is, there may be less room for disappointment with a lowered bar, especially with a massive buyback announcement likely.

“Expectations aren’t very high this quarter, but if we get a better outlook, coupled with some reasons for excitement over AI, we could see the valuation start to expand quite a bit,” said Matt Stucky, chief portfolio manager at Northwestern Mutual Wealth Management. “It might be tough to count on that, but Apple is a high-quality defensive stock, with a lot of shareholder returns and cash flow. The shareholder returns are the dominant reason to have a position.”

Analysts expect Apple to add another $90 billion to its repurchase program, suggesting it will follow Alphabet Inc. and Meta Platforms Inc. among the big-tech names that have announced huge buybacks this year. Apple has already spent more than $650 billion buying back its own stock since 2012, according to data compiled by Bloomberg.

The buybacks have been a way for Apple to support earnings. Revenue is expected to fall almost 5% this quarter, which would represent its weakest rate in more than a year, as well as Apple’s fifth quarter of the past six with negative growth. Overall tech revenue is expected to rise 8.6% this quarter, according to Bloomberg Intelligence.

The growth trends largely reflect the Greater China region, which accounted for nearly 19% of Apple’s 2023 revenue. The company has seen weak China iPhone sales as it loses market share to Huawei Technologies Co.

The stock is down 10% this year, compared with a gain of 3.9% for the Nasdaq 100 Index. Relative to the tech-heavy benchmark, Apple’s underperformance in the first quarter of 2024 was its sharpest in more than a decade. The stock rose 1.9% on Thursday.

Analysts are largely cautious. The consensus for Apple’s full-year revenue has dropped 2.2% over the past quarter, while the view for its net earnings is down 0.8%. Fewer than 60% of the analysts tracked by Bloomberg recommend buying the stock, a ratio well below that of other megacap tech.

Still, such headwinds could be priced into shares following the year-to-date drop. Bernstein upgraded the stock earlier this week, calling the China weakness “more cyclical than structural” and urging investors to “buy the fear.” Similarly, Citi sees a bottom in sentiment.

Read more: Apple Report to Show How It’s Coping With Slowdown: Preview

The stock hardly scans as a bargain, though, trading near 25 times estimated earnings. While this is notably below a 2020 peak, it is still above its long-term average, as well as the market overall. Furthermore, other megacaps have multiples that are comparable or even lower despite their stronger growth trends.

“It is harder to find an argument to buy Apple compared with the other megacaps,” said Daniel Morgan, senior portfolio manager at Synovus Trust. “It can’t substantiate growth, it doesn’t have a killer AI strategy, and it isn’t even cheap.”

The iPhone maker is among the last of the megacaps to report, and the group’s results have been mostly positive. Microsoft Corp, Alphabet Inc., and Amazon.com Inc. all gained, while Meta Platforms Inc. fell on a mixed revenue forecast and its spending plans. Nvidia Corp, the chipmaker most tied to AI, reports later this month.

Read more: Apple’s OpenAI Talks Intensify as It Seeks to Add AI Features

A common theme for megacap upside has been AI-related demand, an area where Apple is relatively absent. However, it is refocusing its Macs on AI, news that spurred the stock’s best day in nearly a year last month, and it has been in talks with both OpenAI and Alphabet about adding some AI features to the iPhone. More details are expected at an event in June.

If the results feature any further details on its AI strategy, that could provide additional excitement. Otherwise, an aggressive capital-return strategy could remind investors what they like about Apple amid a backdrop marked by high inflation and uncertainty over Fed policy.

“I’m a long-term Apple bull, and while I’m turning pessimistic about it in the near term, I’m trying to err on the side of optimism,” Morgan said. “Headwinds seem pretty priced in and it has a huge cash hoard, so repurchasing shares and increasing its dividend could reinvigorate interest. However, until it finds a way to really reignite growth, I think the stock could be stuck in the mud.”

Tech Chart of the Day

SK Hynix Inc. revealed that its capacity to make high-bandwidth memory chips is almost fully booked through next year, underscoring the intense demand for semiconductors essential to artificial intelligence development. The firm is aiming to keep ahead of Samsung Electronics Co. in providing advanced components, which work alongside Nvidia Corp. accelerators in creating and hosting AI platforms.

Top Tech News

Universal Music Group NV, the world’s biggest record label, said it has entered a new licensing agreement with TikTok, ending a dispute that led to its artists’ songs being pulled from the social media platform.

Intel Corp. is attempting a comeback with massive spending on new factories and lots of help from the Biden administration.

Qualcomm Inc., the world’s biggest seller of smartphone processors, gave an upbeat forecast for sales and profit in the current period, suggesting demand for handsets is increasing after a two-year slump.

Elon Musk’s latest cost-cutting victims: summer interns. Tesla Inc. is rescinding offers just weeks before internships were set to start, prompting aspiring employees to take to LinkedIn to appeal to other employers to take them in.

Huawei Technologies Co., the Chinese telecommunications giant blacklisted by the US, is secretly funding cutting-edge research at American universities including Harvard through an independent Washington-based foundation.

Earnings Due Thursday

Premarket

CyberArk

Macom

Arrow Electronics

Vontier Corp

Insight Enterprises

Itron

Belden

Appian

InterDigital

SolarWinds

CoreCard

Postmarket

Apple

Motorola Solutions

Expedia

Fortinet

Cloudflare

GoDaddy

Open Text

Dolby Labs

Universal Display

Altair Eng

BILL Holdings Inc

Workiva

Five9

Sprout Social

Silicon Motion

Viavi

Cohu

Bigbear.ai

OneSpan Inc

Magnachip Semiconductor

--With assistance from Subrat Patnaik and Yoolim Lee.

(Updates to afternoon trading.)

Most Read from Bloomberg Businessweek

A New Kind of Power Company Will Put a Battery in Every Home

Boom Times Are Over for Food Startups, But That’s a Good Thing

Chris Dixon’s Campaign to Overhaul Crypto’s Grifty Reputation

©2024 Bloomberg L.P.